Call Today! 888-234-8376

Best Life Insurance Companies

Everyone starts the life insurance journey in a different place. One person needs a policy that is a good choice when starting a family or buying a home. Another is older and wants to cover their final expenses. Some shoppers know exactly what kind of policy they want, while others know only their goals.

What do all these people have in common? At some point, they’ll need to know which company to choose.

Whatever your goals, check out our top life insurance companies list and see what might be best for you.

Our Top 10 Life Insurance Companies for 2020

- Mutual of Omaha: Best overall life insurance

- Protective: Best value life insurance

- Banner: Best term life insurance

- Northwestern Mutual: Best whole life insurance

- Haven Life: Best no medical exam life insurance

- AARP: Best life insurance for seniors

- AIG: Best final expense life insurance

- Gerber: Best life insurance for kids

- Pacific Life: Best universal life insurance

- AFLAC: Best AD&D life insurance

Call today: 888-234-8376

There are legions of life insurance providers out there, so how do you choose the best one? We started with the basics: financial stability, claims, and customer service. These elements factor into our propriety ratings and reviews.

We then looked at what matters most to people—things like specific policy types, value, and no exam options—and chose companies that excel at those things. We don’t have a numbered top ten list. Instead, you’ll see a collection of standout companies that excel at one or more aspects of life insurance.

To learn more about our editorial, review, and life insurance company ratings process, check out our methodology page.

*Ratings from AMBest.com, NAIC.org, JDPower.com, and Termlife2Go.com. Data effective 12/4/2019.

**Ratings are for Mass Mutual, parent company and underwriter for Haven Life.

***Ratings are for New York Life, parent company and underwriter for AARP life insurance.

****Ratings are for American General, parent company and underwriter for AIG life insurance.

Mutual of Omaha: Best overall life insurance company

Is Mutual of Omaha the best choice for everyone? Of course not. But we chose this company as the best overall because this top-notch insurer can meet the needs of people in many situations.

Solid financial footing

Owned by policyowners

Possible dividends

Limited online customer service

No particular specialty

Let's start with the basics. Mutual of Omaha was founded in 1909, earns solid financial ratings, and maintains a nearly spotless complaint record. You can rest assured "Mutual of O" knows how to do life insurance.

This insurance company is like what a credit union is to the banking industry: customers own Mutual of Omaha. That means Mutual of Omaha may pay out dividends to policyholders. It also means Mutual of Omaha typically places more importance on customer satisfaction than sales. That said, you’ll have to call into the company’s service line to make changes to your policy because the United of Omaha website isn’t set up for that.

Still, this Fortune 500 company offers plenty of policy options (that you can apply for online), including no exam and accidental death and dismemberment (AD&D) policies.

Learn more with our Mutual of Omaha Life Insurance Review.

Protective: Best value life insurance company

Protective checks the boxes most people want in a life insurance company, including financial stability, low complaint levels, decent customer service, and standard policy options. But the real value comes from this insurer’s low prices.

Low prices

Financial stability

Low compliant ratio

Average customer service

Slow application approval

Zero no exam policies for term life

Protective Life Insurance Company offers term, universal, and whole life insurance—often at lower prices than competitors. It’s not always the cheapest, but Protective pops up across policy type, coverage level, and gender when we sample the lowest life insurance rates.

While term life insurance is typically the cheapest type of policy any company offers, Protective’s offerings include a universal life policy that’s usually only a few dollars more. That permanent life insurance policy could grant

more accessible long-term coverage for cost-conscious shoppers.

Of course, Protective’s pricing isn’t perfect. If you smoke (or used to smoke), Protective may not seem like such a good deal.

Still, most people will find Protective’s low prices an excellent value.

Learn more with our Protective Life Insurance Review.

Or, if Protective doesn’t seem like the right insurance company for you, check out other inexpensive life insurance companies.

Banner (Legal and General): Best term life insurance company

Banner provides life insurance under the Legal and General brand, one of the largest insurers in the world.1 Banner was founded in 1949 as the Government Employees Life Insurance Company (GELICO) and later bought by Legal and General. This company offers multiple types of insurance, but its term policies are particularly outstanding.

40-year term options

Rider and conversation options

Exam usually required

$100K coverage minimum

Banner offers more policy options than most, including up to 40-year terms. Since most companies max out their terms at 30 years, that’s impressive. And if you buy a term life insurance policy from Banner and later decide you want permanent life insurance instead, you may be able to convert your policy.

Banner’s term life insurance policies are usually inexpensive and are especially competitive for people who have sleep apnea. While term beneficiaries won’t be able to take advantage of Banner’s fast-tracked claims process (it’s only for payouts of $10,000 or less), Banner makes it a point to pay out claims quickly.

This insurer also offers enough financial stability to be around at claims time, whenever that may be. This company is relatively young in insurance years, but its parent company, Legal and General, has been around for more than 180 years.

Learn more with our Banner Life Insurance Review.

Not sure Banner would work for you? Check out more of the best term life insurance companies.

Northwestern Mutual: Best whole life insurance company

Northwestern Mutual gave our best overall pick a real run for its money, but this insurer’s standout whole life insurance landed it our best whole life award instead.

3 whole life policies

Term and universal plan options

Top-notch ratings

No online quotes

Many insurers offer a single whole life policy, but Northwestern Mutual goes further with three options. A straightforward whole life policy allows for lifetime coverage and premiums. Meanwhile, two additional options allow the policy owner to “pay up” the policy at age 65 or 90 but continue to receive coverage until death.

Meanwhile, Northwestern Mutual CompLife policies combine the benefits of both term and whole life. These policies act like term life insurance at first, giving you a large amount of coverage for several years, then convert to whole life.

Northwestern Mutual provides high returns on a policy's cash value. This company has paid out dividends to policyholders for the last 100 years straight.

Finally, Northwestern Mutual has the highest financial ratings we’ve seen and a super low complaint ratio from the NAIC. J. D. Power ranks this insurer first out of 24 in customer service.2

Learn more with our Northwestern Mutual Life Insurance Review.

Not sure Northwestern Mutual is the right company for you? Check out more of the best whole life insurance companies.

Haven Life: Best no exam life insurance company

Haven Life is an online life insurance company that uses artificial intelligence in its innovative underwriting process. It offers higher death benefits (up to $1 million) than many other insurers provide for a no exam policy.

Instant coverage (if you qualify)

Competitive premiums

Backed by Mass Mutual

No sales agent

Term life policies only

Not ideal for people with preexisting health conditions

If you’re 59 or younger, in good health, and choose a $1 million death benefit or less, you could have instant coverage without taking an exam. If you want a higher death benefit (up to $2 million), are 60 or older, or have health issues, you may have to take an exam to apply for coverage.3

Certain health conditions may result in applicants taking a medical exam. Still, Haven Life makes our best-of list because those who qualify for a no exam policy typically receive super low life insurance premiums compared to other companies.

Haven Life’s AI-fueled underwriting and fully online process means it doesn’t have to pay a team of underwriters or large agent commissions. And the company passes those savings along to customers.

Finally, Haven Life is backed by MassMutual, a large, financially stable insurer that almost snagged a spot on our best-of list, all on its own.

Learn more with our Haven Life insurance review.

While Haven Life made our best-of list for its no exam term policies, it may not be ideal for people with preexisting conditions. If that's you, read our list of top 10 no exam life insurance companies. Plenty of other companies offer no exam life insurance plans for people in your situation.

AARP: Best life insurance company for seniors

If AARP backs a product, you know that product caters to older adults. That’s certainly the case with New York Life’s AARP life insurance. Of course, you’ll need to be an AARP member to apply for one of these policies.

No medical exam required

Backed by New York Life

Term, whole, and guaranteed acceptance

for AARP members only

$100K coverage limit

AARP policies come with the backing of New York Life, a top-rated insurer when it comes to financial stability and service. Unlike New York Life’s other policies, AARP’s offerings require membership in the organization to receive coverage. If you’re not a member already, you could sign up for as little as $12.4

AARP offers three types of policies, each with a different death benefit cap.

- Term life: $100,0005

- Whole life: $50,0006

- Guaranteed acceptance whole life: $25,0007

Unfortunately, the guaranteed acceptance option may require a waiting period of two years before you receive full coverage. The good news? No matter which option you choose, you won’t have to take a medical exam to get AARP's life insurance for seniors.

Learn more about AARP life insurance.

Not sure about AARP? Check out our list of best life insurance companies for seniors.

AIG: Best final expense life insurance company

While many people need insurance coverage to replace their income if they die, people who simply want to cover their burial and other final expenses would do well to consider AIG. It’s a financially stable insurance company that offers options designed to cover end-of-life expenses.

Guaranteed issue

Chronic and terminal illness riders

$25,000 maximum death benefits

High level of complaints

AIG’s best final expense option is guaranteed issue, so you won’t have to take a medical exam or even answer health questions. Coverage caps out at $25,000 (common for final expense insurance), but that could be all you need to cover your funeral expenses.8

AIG’s final expense insurance also includes chronic and terminal illness riders at no additional cost. These riders provide a portion of the death benefit to help you cover chronic or terminal illness while you’re still living. They make AIG’s life insurance a terrific way to receive the kind of living benefits many people need near the end of their lives.

While A.M. Best gives AIG a strong financial rating of A. Unfortunately, the NAIC reports that American General has received a large number of complaints for its individual life insurance.

Learn more about AIG life insurance.

Not sure AIG is the right insurance company for you? Check out more of the best final expense life insurance companies.

Gerber: Best life insurance company for kids

Life insurance for children is different than products designed for adults because kids don’t have an income to protect—other than all that lemonade stand revenue, of course. So choosing a child’s life insurance policy is different than choosing one for an adult. And Gerber gets that.

Low cost

Double coverage starting at 18

Wide coverage range

Cash value grows slowly

Sold only through Gerber

Gerber Grow-Up may be the most famous life insurance for children—and with good reason. This baby food company knows behind the act of insuring a child lies an investment in your kid’s future: a guarantee of insurability later in life.

Parents can choose from $5,000 to $50,000 in coverage for now, knowing the policy will double in coverage and convert to a guaranteed issue policy at age 18. And you won’t pay a dime more in premiums to make all that happen.9

The main downside is Gerber’s cash value grows slowly, so you may not want to buy it to fund your child’s education or a wedding later in life.

Learn more about Gerber Grow-Up life insurance.

Not sure Gerber is the right insurance company for you? Check out more of the best life insurance companies for kids.

Pacific Life: Best universal life insurance company

Pacific Life offers a variety of life insurance options and has high marks for both financial stability and customer service. Because this insurance company has so many universal life options, however, it’s our top choice specifically for that type of life insurance.

Huge policy variety

Top financial and service ratings

Competitive cash value growth

Quotes not available on Pacific's website

Pacific Life insurance offers numerous universal life options, including four each of universal life, indexed universal, and variable universal. These policies provide features such as guaranteed death benefit protections (so your policy doesn't lapse), competitive cash value growth, and survivorship life insurance.

Top financial ratings, a low complaint ratio, and above-average customer service—according to J. D. Powers10—make this company a top option for universal life.

Learn more about Pacific Life insurance.

Not sure Pacific is the right insurance company for you? Check out more of the best universal life insurance companies.

AFLAC: Best Accidental Death and Dismemberment (AD&D) life insurance company

Accidental death and dismemberment (AD&D) insurance is often used as additional life insurance because it doesn’t cover all causes of death. Luckily, AFLAC specializes in supplemental insurance and its AD&D policies are top-notch.

Financial stability

One-day claim approval

Supplemental insurance

AFLAC typically targets employees, unions, and other groups for most of its products. But when it comes to accidental death and dismemberment insurance, individuals can easily buy a policy with this top company.

Solid financial ratings mean this insurer is reliable, while a low complaint ratio indicates this company treats its customers well. This insurer also stands out from the pack by paying out claims in a single day if you file before 3 p.m ET, Monday through Friday

AFLAC specializes in supplemental insurance, and AD&D falls in that category. If you’re looking for this type of life insurance, include AFLAC in your search for the right company.

Learn more about AFLAC life insurance.

Not sure AFLAC is the right insurance company for you? Check out more of the best AD&D insurance companies.

Not sure what matters most about life insurance? That’s okay. Here’s what you should know about shopping for life insurance so you can decide what’s important to you.

Not everyone needs life insurance

Life insurance protects your loved ones, but not all loved ones need the kind of protection life insurance provides. Many people buy policies to replace lost income that their families depend on, pay off a mortgage, or pay a child’s college tuition. But if you don’t have children, large debts, or a spouse who depends on your income to stay afloat, you might get more value out of saving or investing your money instead of paying premiums.

If your family or friends would be in a tight spot financially if you passed away, then you probably need life insurance. But if your death won't affect their bank accounts, then you probably don't. Ultimately, it’s up to you.

Read more about the advantages and disadvantages of life insurance.

Term life is usually a good choice, but not always

Term life is often the cheapest type of life insurance. This coverage ends after a specific number of years, so it may be a good match for coverage while raising kids or paying off a mortgage.

But a term life policy may not be right for everyone. Some people don’t want coverage with an expiration date and don’t mind paying more for permanent coverage. They might want a policy that ensures their heirs have an inheritance. Or maybe they want to cover burial expenses indefinitely. For these shoppers, permanent life insurance might be a better choice.

Life insurance rates will vary

As you shop around for life insurance policies, you may notice that some insurers offer quotes on their website, while others don’t. To see a quote, you may have to answer some personal questions about your income, health, and lifestyle. If you do so, you may also notice the fine print says your actual rates may vary.

While all that may feel frustrating, insurers aren't trying to give you the runaround. The truth is, insurers can't accurately price a policy without a clear picture of the factors that affect your life expectancy.

Learn more about how companies underwrite life insurance.

You should also know that life insurance rates (and whether your application is approved) can vary between insurers, so shop around. You can do the leg work yourself, or you can save some time and work with an independent life insurance agent who can quote from several companies all at once. Get started with our quote tool.

Cheaper isn’t necessarily better

While we're talking numbers, you should know that the cheapest life insurance policy isn’t necessarily the right policy. People who have preexisting conditions, for example, will probably see super low quotes for Accidental Death and Dismemberment (AD&D) policies. But that’s because this insurance doesn’t cover preexisting conditions.

Meanwhile, a life insurance company that offers a lower price than other insurers may not have the best customer service or financial track record.

Cost is an essential factor for many people, but it's not the only factor that matters. Make sure that whatever price you pay, it's for a life insurance policy that fits your needs.

We all know we need to take care of our loved ones after we’ve passed. But not everyone is as financially prepared as others and the last thing you want is to leave your family with credit card debt for funeral expenses because you didn’t have a life insurance plan.

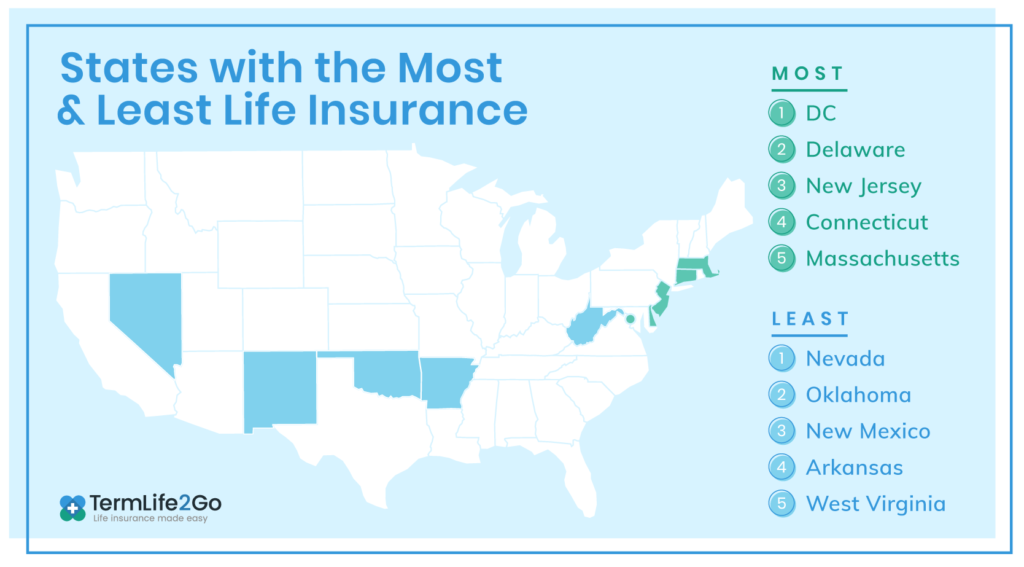

At TermLife2Go, we wanted to break down which states have the most life insurance. In turn, we also found out which states may want to upgrade their life insurance coverage to ensure they’re leaving their loved ones with enough to help sustain them.

Washington, DC, has more life insurance per capita than any other state. We appreciate that level of preparedness in our nation’s capital. And coming in second? Delaware. It’s interesting that the east coast took our top five spots—what do they know the rest of us don’t?

West Virginia is the least insured state in the US, meaning that they’re less prepared in the event of an untimely death. West Virginia, like other states in the lower ranks, also has one of the lowest median household incomes.

In general, there’s a correlation between median household income and a state’s rank for life insurance coverage, but it’s not a hard and fast rule. Nevada, for instance, has the 26th highest median income but still ranks low for life insurance coverage per capita.

It’s important to consider factors like how many companies sell life insurance in that state, people’s attitude toward life insurance, or other external factors.

Are you prepared for death and all its expenses? We’ve put together a list of resources that may help you understand that life insurance isn’t as expensive as you think it is.

TermLife2Go ranked each state by the average amount of life insurance coverage its residents had on the books as of 2018. First, we compiled the total face amount, or dollar value, of life insurance death benefits across each state. Then we divided that amount by the US Census Bureau’s population estimates to get the dollar amount of coverage per capita. The higher the resulting amount, the better the state ranks on our list.

The bottom line

The best life insurance company depends on your situation. There's no one-size-fits-all company because each offers its own variety of products and companies price policies differently.

It’s always a good idea to make sure an insurer has solid financial ratings, low complaints, and attentive customer service. But beyond that, go with the insurance company that matches your goals.

Still have questions about life insurance? No worries. Check out these resources that have helped people like you wrap their minds around life insurance:

- Read more about what life insurance is.

- Find out how much life insurance costs.

- Understand the various types of life insurance.

- Learn how much life insurance you need.

Or, if you’re ready to buy life insurance, get a quote.

AM Best is the gold standard for evaluating insurance companies, but ratings from Standard and Poor's, Fitch, and Moody's can also be helpful. Also, look for JD Power customer service ratings (only the largest companies have them) and officially filed complaints with the National Association of Insurance Commissioners (NAIC). We use all these ratings in our life insurance company reviews.

How insurance companies price their coverage varies widely, but each rate is highly personalized to you. Some insurers have better prices for people with specific conditions, like heart disease or diabetes, while others have low rates for tobacco users. The cheapest insurance company depends on your unique situation.

People tend to ask which is better: Term or whole life insurance? Although those two aren't the only types of life insurance, financial experts hotly debate the question. The truth is, it depends on your situation. Term life insurance is cheaper, short-term, and straightforward. Whole life insurance is more expensive, covers you for life, and comes with a cash value component that can get pretty complex. Luckily, we have an article that dives more deeply into the debate between term and whole life.

Some people buy multiple life insurance products to meet different needs. They might purchase a 30-year $250,000 term life policy to cover the mortgage and a 15-year $1 million policy to ensure income replacement until the kids grow up.

This strategy is called the ladder strategy for life insurance, and it could save you a lot of money. If laddering your policies feels intimidating then you might want to consider Ladder life insurance, an online insurance company that gives customers easy access to adjust their policies as needed.

Sources

1 Legal and General, “Financial Strength”

2 J.D. Power, "Life Insurance and Annuity Providers Are More Customer-Centric but Gaps Remain, J.D. Power Finds"

3 Haven Life, “Estimate Your Life Insurance Policy Rate”

4 AARP, “Membership”

5 AARP, “AARP Level Benefit Term Life Insurance”

6 AARP, “AARP Permanent Life Insurance”

7 AARP, “AARP Guaranteed Acceptance Life Insurance”

8 AIG, “Guaranteed Issue Whole Life Insurance”

9 Gerber, “Gerber Life Grow-Up Plan”

10 J.D. Power, "Life Insurance and Annuity Providers Are More Customer-Centric but Gaps Remain, J.D. Power Finds"

Additional sources:

American Council of Life Insurers, “ACLI 2018 Data “

US Census Bureau, “2018 Population Estimates”

US Census Bureau, “American Community Survey”