Call Today! 888-234-8376

Best Life Insurance for Seniors: Top 5 Life Insurance Companies

If you’re looking for the best life insurance for seniors while approaching or enjoying retirement, you’re in the right place. Many seniors think they’re uninsurable after their 65th birthday, but that’s far from the truth.

While you have fewer or more expensive life insurance policy options than your children or grandchildren, plenty of excellent life insurance companies offer coverage that may fit your needs. To help you find quality coverage, we’ve analyzed the best life insurance options for seniors.

Best life insurance companies for seniors

If you are a senior searching for life insurance it is important to shop around for the best quotes. Below we have highlighted the top five life insurance companies for seniors.

All rates are for a healthy, 70-year-old female. Rates are for illustration purposes only. Actual quotes may vary. Rates are from NYLAARP.com, LGAmerica.com, StateFarm.com, Chris Abrams at MJLifeInsurance.com and a Clearlink partner. Data effective 11/19/2019.

Call today: 888-234-8376

AARP—Best overall life insurance for seniors

The American Association of Retired Persons (AARP) is well-known for recommending quality products and services for seniors, and AARP’s life insurance is no different. Backed by one of the largest life insurers in the US, AARP policies offer insurance coverage without a medical exam for people 50 and older.

AARP offers both term and permanent policies. You can buy term life insurance, as well as convert this insurance policy to permanent guaranteed acceptance coverage, up to age 80. Meanwhile, all AARP policies are backed by New York Life Insurance Company, which earns top financial stability marks (AM Best gives New York Life its highest possible rating2) and offers excellent customer service.3

Learn more about AARP life insurance.

Mutual of Omaha—Best universal life insurance for seniors

Mutual of Omaha was founded in 19094 as a mutual company, which means policyholders own the company and may receive dividends each year. This insurer receives high marks for financial stability and has a squeaky-clean claims history. Meanwhile, J.D. Power ranked this insurer number 3 of 24 for overall customer service in 2019.5

This insurer offers four universal life policies. Two of these policies focus on guaranteeing a death benefit to age 85 (or, if you choose, your lifetime) and focus less on building cash value. Choose from straight universal life or an indexed universal life policy.

Finally, while this insurer earns our Best Universal Life Insurance for Seniors title, its term life policies are robust too. You can apply for them until age 74 and have coverage until your 80th birthday. These policies also come with the option to convert to permanent life insurance.

Learn more about Mutual of Omaha.

Banner Life—Best final expense life insurance for seniors

Banner was founded in 1949 and sells life insurance under the Legal and General brand. This insurer has stable financial strength ratings and a clean claims history, making it a reliable company all around. Banner also offers some of the best final expense insurance on the market for seniors and older adults.

Banner Life’s final expense policies provide a death benefit of up to $15,000 for people ages 50 to 80, which may be enough to cover some funeral costs. While most insurers offer a higher final expense death benefit, Banner provides other benefits that make it stand out for seniors. No matter what age you apply for a policy, for example, you won't have to take a medical exam, acceptance is guaranteed, and you can apply online. You may need to answer health questions, however.

With Banner’s final expense insurance, you’ll pay premiums only until age 90 but receive lifelong insurance coverage. Policies $10,000 and under come with fast-tracked claims, so your beneficiaries could receive the death benefits payout in as little as one business day.

While Banner earns our Best Final Expense for Seniors award, its term and universal life policies offer quality coverage as well.

Learn more about Banner Life insurance.

State Farm—Best term life insurance for seniors

State Farm consistently reaches the top of J.D. Power’s US Life Insurance Study for overall customer satisfaction, snagging #1 in 2018 and #2 in 2019.6,7 While this insurer is best known for auto coverage, its transparent approach to service and policy variety are also a boon for seniors and older adults looking for life insurance.

State Farm offers term life insurance to applicants up to 75 years old. Premiums are guaranteed level for the length of your term, then increase annually until age 95. Or, you can convert your policy to permanent life insurance.

Since many companies stop offering term life or limit conversion options starting at age 65, State Farm’s options stand out. Still, this insurer is best for healthy people and those without preexisting medical conditions. That’s because State Farm’s health rating standards are more rigorous than other insurers. If you’re in excellent health, however, you could see competitive rates with this company.

With State Farm, you may also be able to add an accelerated death benefit rider, which allows you to use some of your death benefit early if you need to pay medical bills before you pass away.

Learn more about State Farm life insurance.

AIG—Best value life insurance for seniors

Also known as American General, AIG is a financially stable company that’s been in business since 1919. This centurion has some of the most affordable life insurance for seniors and a clean claims history, but its customer service could be better.

AIG offers multiple products that appeal to older adults and seniors. This insurer’s guaranteed acceptance whole life policies essentially act as final expense insurance, providing low death benefits at low monthly premiums. Meanwhile, AIG’s term life prices are steep for young people—but highly competitive for adults 50 and older.

AIG's Quality of Life products automatically add accelerated death benefits, such as chronic, critical, and terminal illness insurance, to your coverage. Applicants can choose from Quality of Life versions of AIG's term, guaranteed universal, and indexed universal life insurance policies.

Learn more about AIG life insurance.

How to choose the right life insurance for seniors

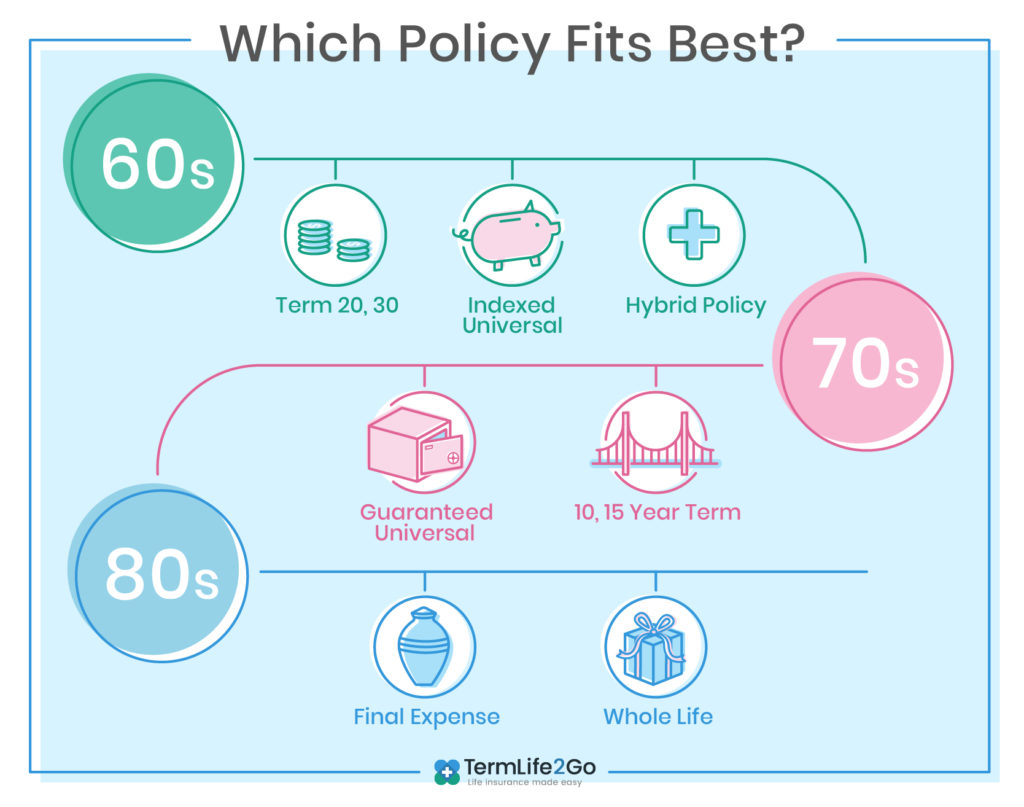

Every person’s situation is different, but seniors in the same age bracket tend to have similar insurance coverage needs. If you’re a senior who’s not sure which type of life insurance you need, find your age group below. We’re going to break down some common concerns your peers have, which may apply to you too.

Life insurance for seniors in their 60s

You might feel some sticker shock if you look at insurance rates when you’re in your 60s. But chances are, you’ll still have plenty of options for buying life insurance. You’ll be able to get quotes for a longer term life policy, such as 20 and 30 years.

If you’re looking for permanent coverage this time around, try indexed universal life. Its flexibility could satisfy your coverage needs for the rest of your life. This policy can also provide low-risk cash value growth you could use to supplement your retirement income later.

Finally, if you’re looking for a life insurance plan to knock out two needs—life and long-term care—a hybrid policy is often cheaper than two separate policies. Just keep in mind that using your long-term care benefits may drain the death benefit payout your beneficiaries receive.

Life insurance for seniors in their 70s

If you’re in your 70s and no longer work, your income probably consists of a mix of Social Security benefits and retirement savings. You may not need to protect your income with life insurance but set aside enough funds to cover your final expenses instead. Hooray for financial independence!

If you’re still building your savings, however, you may want a short-term policy to help tide you over for a few years. A 10- or 15-year term could be a good option for you.

If you think you’ll need coverage indefinitely, however, a guaranteed universal policy might be a low-cost, low-risk choice.

Life insurance for seniors over 80

At age 80 and beyond, you’re unlikely to find a company that will offer you term insurance. Instead, your lowest-cost option is likely final expense insurance. The death benefit will be low (typically $1,000 to $25,000), but most policies won’t require a medical exam.

If cost isn’t an issue and your main goal is to minimize estate taxes on an inheritance, consider whole life insurance. Premiums will be some of the highest in the industry, but you’ll have coverage for life, and your beneficiaries will receive the death benefit payout tax-free.

Planning Your Future

While planning for your family's future, consider creating a will using Fabric. Fabric is an online life insurance company that also offers a free will creation service and more.

Best types of life insurance for seniors

Many life insurance companies offer several products designed for seniors, but the best policy for you depends on your health, goals, age, and other factors.

Term life insurance for seniors

Term life insurance is usually the least expensive option for people of any age. Most insurers begin limiting the term lengths once you reach 55 or 60, so you may not find many 30-year term options after that. Once you reach 65 or 70 years, you’ll likely have limited 20-year term options as well, and so on.

Still, if you need coverage for only a limited number of years, term life will probably be your best bet.

Final expense life insurance for seniors

Insurance death benefit payouts for final expense insurance are typically $1,000 to $25,000, making them a popular option for covering end-of-life expenses, such as funeral and burial costs. But don’t let the name fool you. Your beneficiaries can use the benefit however they see fit.

Typically, final expense policies are a kind of whole life insurance. You’re covered for life, provided you continue to pay your premiums. Additionally, many of these policies are either guaranteed issue or no exam life insurance (although some will require you to answer health questions), making them an excellent option for those with preexisting health conditions.

Indexed universal life insurance for seniors

Universal life insurance is permanent insurance that allows the policy owner to adjust their premiums and benefit as needed. Seniors who see big changes in their future, such as retirement, travel, or downsizing, may want the flexibility of this type of policy.

All universal life policies come with a cash value, but indexed universal policies are the only ones that match your cash value growth to an index such as the S&P 500. By choosing this policy, you’ll have life insurance and a low-risk investment to help top off your retirement savings.

Guaranteed universal life insurance for seniors

This type of universal life insurance is popular among seniors. It’s less expensive than whole life but can cover you long after a term policy would end. Like other forms of permanent life insurance, guaranteed universal life coverage comes with a cash value that acts like a savings account that grows and shrinks over time with the market. Unlike other forms of universal life, this type of policy comes with minimal risk.

The “guarantee” in this type of policy refers to your coverage. No matter how your cash value investment changes over time, your coverage won’t lapse as long as you pay the same minimum premium. Unlike other permanent policies, however, this policy’s cash value may not grow much. Guaranteed universal life insurance also provides the same low risk as whole life insurance.

If you’re looking for inexpensive permanent coverage, a guaranteed universal policy could be right for you–as long as growth of cash value is not one of your priorities.

Hybrid life and long-term care insurance

The cost of long-term care insurance is on the rise, making it increasingly unattainable for many seniors. Add to that the fact that 30% of people will never need long-term care,1 and this type of insurance may not seem worth the cost. Still, if you do someday need long-term care in a nursing home or with home health care, Medicare won’t pay for most of these services.

But here’s where hybrid policies and long-term care riders can help. These products allow policy owners to combine two types of coverage—life insurance and long-term care insurance—with a single, cost-effective premium.

Here’s how it works: as with other life insurance policies, you’ll choose a death benefit amount, say $500,000. If you require long-term care later in life, you’ll be able to pull from that benefit to pay for those services. Keep in mind, your beneficiaries will receive a lower payout. But if you never need long-term care, your beneficiaries will receive the full $500,000 death benefit when you pass away.

If you’re considering long-term care insurance and feel trapped between a rock and a hard place, a hybrid policy could be right for you.

Whole life insurance for seniors

Whole life is a kind of permanent life insurance policy. In general, it’s also the most expensive type of life insurance, so it’s the rare senior who can afford the premiums.

If cost isn’t an issue, whole life can be a great way to leave a tax-sheltered inheritance for your beneficiaries.

Cheap life insurance for seniors

Life insurance for senior citizens can be expensive, so if you have a limited budget for a policy, you're not alone. But you should know that the cheapest life insurance isn't always the best choice.

Cheap life insurance for seniors may seem appealing, but sometimes these policies end up costing you or your beneficiary more in the long run. Graded premium policies, for example, begin with super low monthly premiums that rise each year. And if you choose a cheap term life insurance policy when you really want a more expensive whole life policy, you could outlive your coverage and never receive a benefit.

In short, take all the costs and benefits into account when choosing life insurance before choosing the cheapest senior life insurance you can find.

- AARP: Best overall life insurance for seniors

- Mutual of Omaha: Best universal life insurance for seniors

- Banner Life: Best final expense life insurance for seniors

- State Farm: Best term life insurance for seniors

- AIG: Best value life insurance for seniors

Our methodology for the best life insurance for seniors

“Seniors” can cover a wide age range and refer to people in a variety of life stages. Choosing the best life insurance companies for a group full of such unique individuals is a challenge, so we decided to focus on the types of life insurance that seniors commonly buy. We chose companies that excel at these insurance policies and offer these products to seniors.

Next, we looked at customer service. Most of our top life insurance companies excel at taking care of policyholders and their beneficiaries. The exception is our best value pick, which prioritized a lower price over top-notch service.

Of course, we also considered our own rating system, which is an objective analysis of a company’s financial stability and claims history.

Bottom line: Seniors have multiple life insurance options

Seniors have different needs while enjoying their 60s, 70s, 80s, and beyond. You may want the low cost of term life or a sure thing like guaranteed universal life. Or, you could have minimal coverage needs that a final expense policy would handle.

While seniors may not have as many coverage options as younger people, many top companies offer quality life insurance for seniors. Still not sure which company is best for you? Compare life insurance quotes and let your budget weigh in.

Want to learn more about life insurance? Check out these pages next:

- Learn what life insurance medical exams involve.

- Check out other best life insurance companies.

- See sample life insurance rates by age.

Sources:

1 U.S. Department of Health and Human Services, “How Much Care Will You Need?”

2 AM Best, “New York Life Insurance Company”

3 J.D. Power, “Life Insurers’ Focus on Customer Experience is Key for Increasing Satisfaction, J. D. Power Finds"

4 Mutual of Omaha, “Company Profile”

5 J.D. Power, "Life Insurance and Annuity Providers Are More Customer-Centric but Gaps Remain, J.D. Power Finds"

6 J.D. Power, “Life Insurers’ Focus on Customer Experience is Key for Increasing Satisfaction, J. D. Power Finds”

7 J.D. Power, "Life Insurance and Annuity Providers Are More Customer-Centric but Gaps Remain, J.D. Power Finds"