Call Today! 888-234-8376

Colonial Penn Life Insurance Review 2020

Update: In the wake of the COVID-19 pandemic, Colonial Penn is one of several insurance companies that is directly addressing customers’ questions about the virus and/or providing specialized service options to ensure the safety of customers and agents alike. For up-to-date information, visit their website.

Colonial Penn was started by one of the cofounders of AARP to bring coverage to a previously unthought-of group: those over 65. Fittingly, the Colonial Penn we know today is probably best known because of Alex Trebek, who stars in daytime TV commercials selling guaranteed issue life insurance for people 50–85, who says you can get coverage for $9.95 per month. If these commercials make anything clear, it's that Colonial Penn sells life insurance for seniors.

While its guaranteed issue life insurance policies targeting seniors are Colonial Penn's bread and butter, you may know that it also sells term and whole life insurance—but with a maximum payout of only $50,000.

Who might choose Colonial Penn life insurance?

- Seniors who may have health issues or don’t want a medical exam: Colonial Penn will sell anyone a guaranteed issue whole life insurance policy, regardless of health conditions.

- People who want burial coverage: Payouts from Colonial Penn are lower, but can be a sufficient way to cover the cost of a funeral or other final expenses.

- Those who don’t need much coverage: None of Colonial Penn’s policies have a death benefit payout larger than $50,000 (a modest amount, in terms of life insurance).

Colonial Penn life insurance policies

Table created for illustration purposes only. Information available at colonialpenn.com/rightchoice. Data effective 12/17/2019.

Colonial Penn renewable term life insurance

Colonial Penn doesn’t sell level term insurance. Instead, they offer 5-year renewable policies that increase in price through each age band, which are (mostly) 5-year increments from ages 18-89. The initial application doesn't have a medical exam, but it does ask medical questions to see if you’re eligible. Premiums, however, are solely based on gender and age. The death benefit, or coverage, for a Colonial Penn term life insurance policy starts at $5K and covers up to $50K.

Renewable term policies initially look much more affordable than level term policies. However, since the premiums go up as time goes on, you may end up paying more for a renewable term than a level term policy.

As a side note, we spotted a red flag on the Colonial Penn term life page where it talks about cash value:

“Depending on how long you've had your coverage, cash value may be available to borrow against at a guaranteed interest rate.”

We’ve never heard of adding cash value to a term life insurance policy, so we dug deeper. After chatting online with three separate representatives, we finally got an answer: Colonial Penn previously sold a 20-year term policy with cash value, but it’s no longer available. We found it a bit misleading to continue advertising a product they don’t currently sell, but that’s just us.

Colonial Penn permanent whole life insurance

Whole life insurance from Colonial Penn doesn’t require a medical exam, but it does ask health questions which could determine your acceptance. Premiums are based on gender and age, and remain level for the life of the policy.

Coverage, or the death benefit, starts at $10,000 and raises in $10,000 increments, up to a maximum of $50K. And since it’s a whole life insurance policy, there’s also a cash value component that you can borrow from when it’s accumulated enough value.

For an increased premium, you can add riders to your policy such as a living benefit rider or an accidental death rider.

Living benefits rider

With the living benefits rider, you can take out part of the policy benefit early.

- If you select “heart attack/stroke” on the application and experience the event, you can take out up to half of your death benefit for immediate use.

- If you select “cancer” on the application and develop cancer, you can take out 25% of your death benefit.

Notably, you have to choose which condition you anticipate developing and be correct to actually have this rider work for you. So if you select cancer but have a stroke, no benefits for you. This rider isn’t available for people 65 and up.

Accidental death rider

The accidental death rider gives the beneficiaries an additional amount if your death is the result of an accident. This rider provides coverage up to $50K on top of your existing death benefit. So if you purchase a whole life policy for $50K from Colonial Penn and add the $50K accidental death benefit rider, your beneficiary could receive up to $100K if you die from an accident.

Pro tip: read the fine print of this rider. You wouldn’t want to mistakenly think you have a free pass to star in your own version of The Fast and the Furious. Well, you could. But Colonial Penn wouldn’t consider drifting in a parking garage “accidental.”

Colonial Penn guaranteed acceptance whole life insurance

Colonial Penn’s flagship life insurance, guaranteed acceptance whole life, has been endorsed for over a decade by the one and only Alex Trebek. Colonial Penn’s guaranteed acceptance whole life insurance works a bit differently than typical policies, selling “units” of life insurance coverage for $9.95 per unit.

One disclaimer: Alex Trebek's advertised life insurance insurance won’t pay if the insured dies within the first two years because of a "graded death benefit." Colonial Penn will return the premiums paid plus interest but will not pay a death benefit if the insured passes away less than two years after purchasing a policy.

Colonial Penn term life insurance rates

Colonial Penn sells term life insurance differently than other companies do, using “age bands” to determine premiums. You can see the premiums for each age band on Colonial Penn, but to make it easier, we did the math of what a 20-year term policy would cost per month, on average.

Sample quotes based on colonialpenn.com and are for illustration purposes only. Actual quotes may vary. Data effective 08/12/2019.

*Rates reflect the average monthly cost throughout the 20-year life of the policy. Term life rates from Colonial Penn start lower and increase each time you enter a different 5-year age bracket.

Colonial Penn whole life insurance rates

Sample quotes based on 65-year-old male on colonialpenn.com and are for illustration purposes only. Actual quotes may vary. Data effective 08/12/2019

Colonial Penn guaranteed acceptance life insurance rates

Sample quotes based on 65-year-old male on colonialpenn.com and are for illustration purposes only. Actual quotes may vary. Data effective 08/12/2019

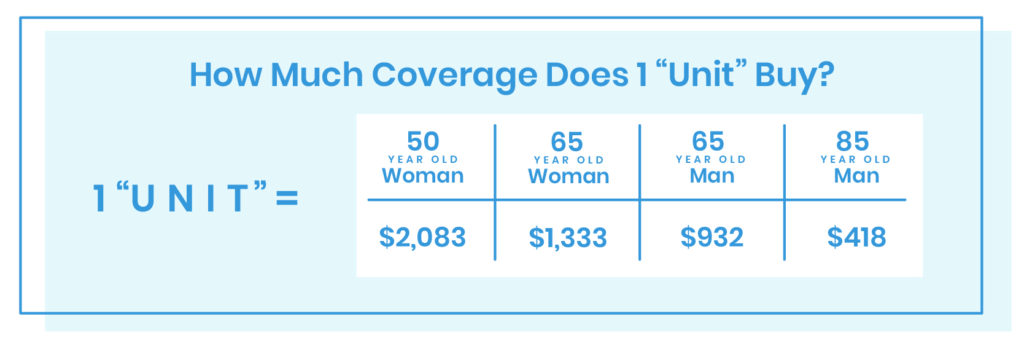

What is a "unit" of life insurance coverage?

The part that’s a little (or a lot) unclear is, what exactly is a “unit” of coverage?

In this case, a "unit" represents the death benefit (or the coverage) someone can get for $9.95. The premium of $9.95 stays consistent, but the insurance coverage varies. And since it's guaranteed acceptance and they don't ask any health questions, the death benefit is based on age and sex. Practically speaking, this means that for $9.95 a month, a 50-year-old female can get significantly more insurance coverage for the price than an 80-year-old male.

While one unit costs $9.95, a person may buy up to eight units, totaling $79.60 per month. Whether or not this is a good deal depends on what you need and how much coverage a unit provides for your age and gender.

For final expense insurance, it could be worth considering.

Things to consider about Colonial Penn

None of Colonial Penn’s policies require a medical exam, and one of their policies doesn’t even ask medical questions. Colonial Penn also has a very user-friendly website, allowing you to get quotes and play with coverage amounts and riders while seeing a breakdown of the costs.

Colonial Penn doesn't provide a great deal of coverage and tends to cost more than competitors.

No medical exams

No medical exam policies are a double-edged sword. They’re much more convenient (and easier for people with a fear of needles), but they may come with the downside of typically higher premiums. If the policy isn’t guaranteed acceptance, health questions can still be asked and used to deny you a policy—even without a medical exam.

If you’re in good health, you can usually get lower premiums with a medical exam. If this is you, life insurance from Colonial Penn may cost you more than another insurance company would.

User-friendly website

Colonial Penn makes getting quotes and playing with coverage amounts quite easy compared to other insurers. Many companies require you to call for quotes or even to see pricing, but Colonial Penn’s site lets you simply plug in your information and see what kind of coverage you can get. If you add riders, it breaks down how much that specific rider adds to your total premium. There’s a chat-for-help sidebar that makes asking questions easy. All these components add up to a very user-friendly experience.

Low coverage amounts

Coverage up to $50K may be adequate for final expense insurance, but it’s likely not enough for income replacement, covering the rest of the mortgage, or setting up your kid’s college fund.

Depending on where you’re at in life, $50K may be more than enough. For others, it’s nowhere close to enough. But for final expense insurance, it could be just right.

How Colonial Penn stacks up

Colonial Penn has been in business since 1963, and based on their financial ratings and annual premiums of $1.2 billion, they’re not going anywhere for a long time.1, 2 Specifically marketing to older Americans since the beginning, their guaranteed acceptance whole life insurance has been a lucrative product for them (and likely for pitchman Alex Trebek too).

Is Colonial Penn financially stable?

Table created using information available at AMBest.com, StandardAndPoors.com, Moodys.com, and FitchRatings.com. Data effective 12/16/2019.

A.M. Best gives Colonial Penn an excellent financial strength rating, and the other three financial ratings organizations place Colonial Penn in the lower end of their top tier for financial strength. Practically speaking, this means that you can be confident Colonial Penn can meet their long-term financial requirements (i.e., pay your claims years from now). Being in the bottom of the top tier means Colonial Penn could be susceptible to some economic risk, but the threat of bankruptcy is quite low.

Colonial Penn claims and customer service

The National Association of Insurance Commissioners tracks complaints and measures them against the entire industry. When talking about individual life insurance products, Colonial Penn gets double the amount of complaints expected for an insurance company of their size. In short, they get a lot of complaints compared to the industry average.

The Better Business Bureau (BBB) gives Colonial Penn a rating of A+.3 While there have been 88 complaints in the last three years, to Colonial Penn’s credit, they responded to each one—either on the BBB page or by reaching out to the individual directly.

Bottom line: Lower coverage limits could be suitable for final expenses

Colonial Penn's guaranteed issue whole life insurance could be a good option for older individuals who need burial insurance. The guaranteed acceptance especially becomes a valid choice for those with medical conditions that might otherwise be passed up for a policy.

However, we encourage anyone to seek out quotes from more than one company, as Colonial Penn is expensive for the coverage it provides.

Colonial Penn sells both term and whole life insurance policies. But the lower coverage amount and likely higher premiums could make Colonial Penn less attractive for families or those who need more coverage. Additionally, healthy individuals should consider life insurance with a medical exam, as rates will be lower if you can pass it.

Still have questions about Colonial Penn? These FAQs may help.

Yes. After paying into your plan for one year, you can borrow against it at a guaranteed interest rate.

No. You do not need to undergo a medical exam or physical or answer any health-related questions when you apply for Colonial Penn’s guaranteed acceptance life insurance.

No. Some Colonial Penn policies are not available in Maine, Massachusetts, Montana, and Vermont. Colonial Penn is underwritten by Bankers Conesco Life Insurance Company in New York, and plan details may vary for residents of the Empire State.

Colonial Penn’s guaranteed issue life insurance is $9.95 per unit—period. You may buy up to eight units, totaling $79.60 per month. The death benefit of one unit varies, however, from about $2,083 for a 50-year-old female to $418 for an 85-year-old male.

Recommended reading

Sources:

- Los Angeles Times, “Leonard Davis; Helped Start AARP and Gerontology Programs at USC”

- National Association of Insurance Commissioners, “Colonial Penn National Complaint Index Report”z

- Better Business Bureau, “Colonial Penn Life Insurance Company”