Call Today! 888-234-8376

Cash Value Life Insurance

If you're considering permanent life insurance, you've probably come across the term "cash value." It's an attractive policy feature that allows you to build a kind of savings account while you pay your life insurance premiums.

But cash value life insurance comes with some downsides. Chief among them: it costs more than other policies.

Is cash value life insurance worth the higher price? To answer that question, it helps to understand how cash value works, what it can do for you, and why it’s not a good fit for everyone.

What is cash value life insurance?

Cash value is a living benefit of life insurance, meaning you can use it while you're still alive. If you decide to cancel your policy, for example, you could get some of your cash value back. With (non-cash value life insurance), however, you’d probably get nothing back if you canceled your policy.

In a cash value policy, a portion of your premium goes toward your death benefit, while another portion remains in your cash-value account to (hopefully) grow over time. Cash value insurance is typically more expensive than term life insurance, which is considered pure life insurance because all you’re paying for is the death benefit.

When you've accumulated enough money in your cash value account, you can use it to help pay your premiums, or (in some cases) you can invest it. How much cash value you need before you can use it depends on your policy, but most people wait several years before their cash value begins growing substantially.

Once you've built enough cash value, you may use this account to help cover your premiums, provide a sort of savings vehicle, or (with some policies) to invest.

Adds a savings/investment component

Can help cover the cost of premiums

Can be used for policy loans to yourself

Can be partially or fully withdrawn

May not grow as quickly as other savings/investment vehicles

Policies are more expensive than term life

May have tax implications

May be more complicated than term life

Which life insurance policies have cash value?

Generally, every type of life insurance except term life has a cash value. The two main kinds of cash value policies are whole life and universal life.

Whole life insurance

Whole life is the simplest type of cash value life insurance. Your premiums and death benefit stay the same throughout the life of your policy, and your cash value is guaranteed to grow at the rate conveyed in your life insurance policy.

Universal life insurance

Universal life insurance allows flexibility with costs, death benefits, and coverage lengths. And, depending on the type of universal policy you choose, your cash value will grow differently.

Guaranteed universal life (GUL) offers little cash value growth but relatively low premiums—sometimes in the same ballpark as term life coverage.

With Indexed universal life (IUL), cash value growth is tied to an index, such as the S&P 500, but isn’t invested directly in the stock market. Insurers typically cap cash value growth a few points below the index the policy follows while ensuring your interest rate never drops below zero.

In a variable universal life (VUL) policy, you can invest your cash value directly in the stock market, with all the opportunities and risks that entails. These policies must be sold by an agent who has securities licenses 6 and 63, in addition to a state license for selling life insurance.1 If you’re interested in variable life insurance, contact one of these agents for more information.

Benefits of cash value life insurance

Cash value may take several years to begin growing. But once it does, there are several things you can do with the funds in your account.

Pay your premiums

Because cash value life insurance premiums are expensive, many policy owners use their cash value funds to help cover these costs. However, doing so may limit how quickly your cash value grows since you won't be earning as much compound interest.

Make withdrawals

If you need the cash for other reasons, you could withdraw some or all of your cash value. Depending on your policy, however, you may decrease your death benefit or lose your coverage altogether. And you might have to pay taxes on your withdrawn funds.

Withdrawing all your cash value is considered a surrender (cancelation) of your policy. In these situations, the insurer will likely levy a surrender charge, which will take a chunk out of the net cash you receive.

Take out a loan on your policy

If you need cash, but don’t want to withdraw from your policy, you could take out a policy loan. You could use these funds for expenses such as a down payment on a home, medical bills, or anything else you want to use it for.

Taking out a policy loan comes with some risks. If you don’t pay the loan back before you pass away, for example, your loved ones may receive a reduced death benefit. However, if your cash value is large enough and the loan small enough, you may not have to pay it back. With careful planning, you can use regular policy loans to help fund your retirement.

But you’ll need to pay it all back, with interest, or risk losing your coverage.

Fund your retirement

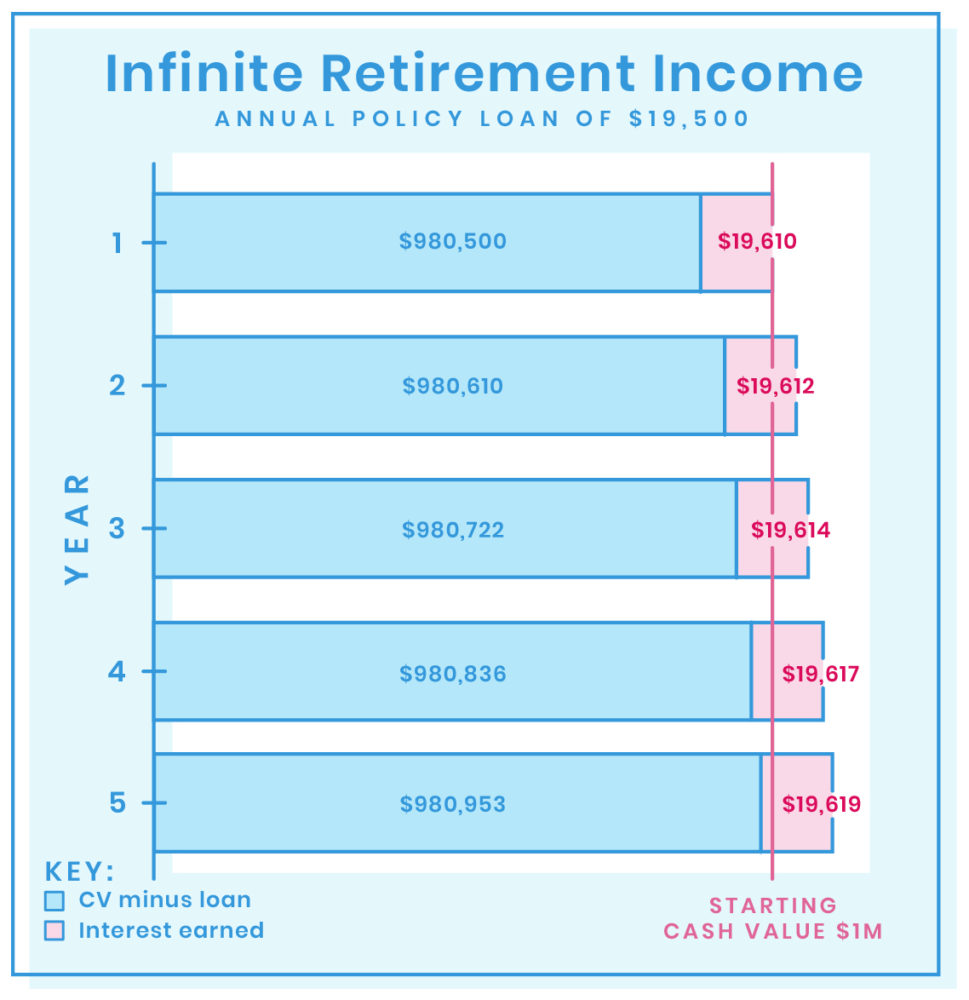

Some policyholders use their life insurance cash value to boost their retirement income using policy loans or withdrawals. When done well, you could access regular funds without jeopardizing your coverage. The trick is purchasing a large policy (usually $1 million or more) and loaning yourself less than your remaining cash value will earn in interest.

Let’s say you have $1 million in cash value that grows at a rate of 2% annually. If you take out a policy loan of $19,500, that leaves you with $980,500. In a year, this remaining cash value will earn $19,610 in interest—more than enough to replace the $19,500 loan. Using this strategy, you could keep your death benefit intact without ever paying back your annual loan.

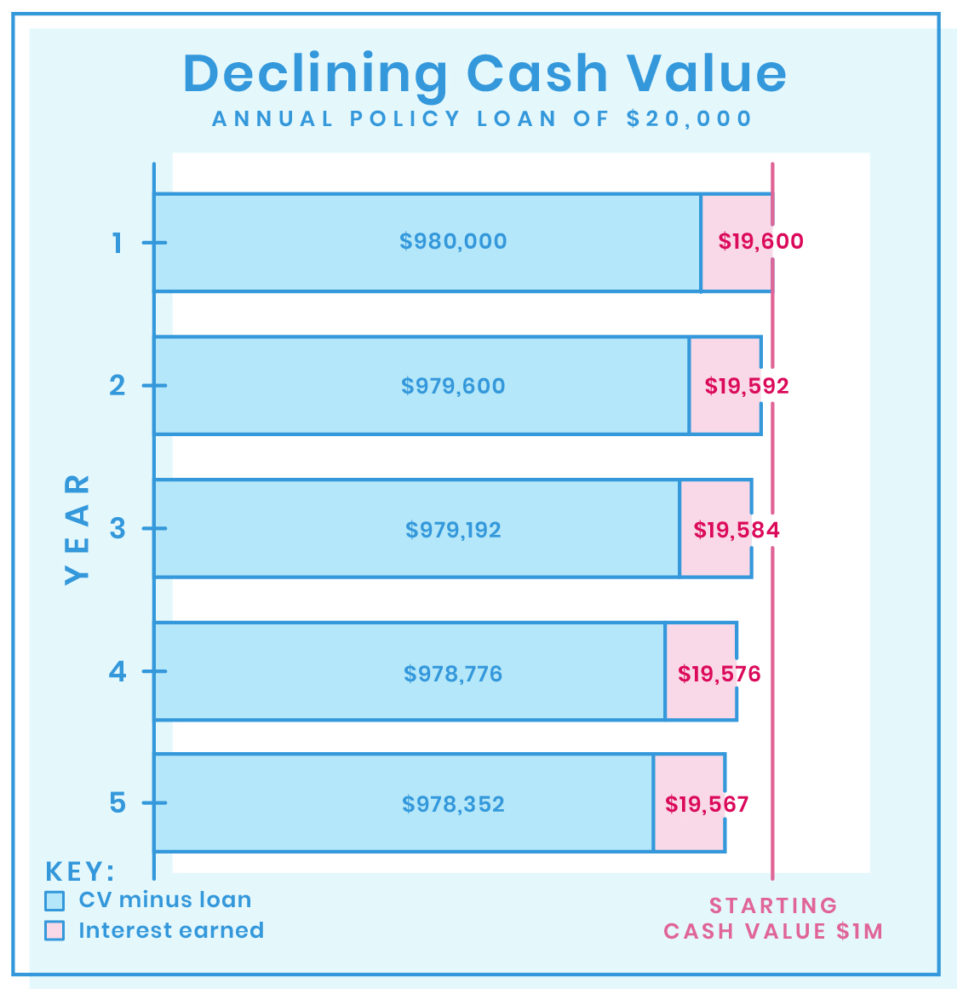

Taking out the right size policy loan is critical. Boosting your annual retirement income by just a few hundred dollars could eat away at your cash value over time.

Using the above example, let's say you take annual policy loans of $20,000 instead of $19,500. During your first year, your remaining cash value would return only $19,600, so you'll start your second year $400 short. At this rate, you'll slowly chip away at your cash value—and possibly the death benefit payout your loved ones receive when you pass away.

If you plan your policy loans well, your cash value policy can give you a steady stream of retirement income. Even better, these loans will enter your bank account without Uncle Sam taking a share first—unlike any retirement funds you withdraw from a traditional 401(k) or Individual Retirement Account (IRA).

Is cash value life insurance worth it?

When used wisely, cash value can bring you and your family financial stability. But there are some downsides too.

High premiums

While cash value benefits can help you build wealth in the long run, this life insurance typically comes with steep premiums compared to term life coverage.

All rates based on a healthy, nonsmoking 25-year-old applying for $1 million in coverage. Sample rates are for illustration purposes only. Actual rates may vary. Rates as of 4/22/2020.

All rates based on a healthy, nonsmoking 50-year-old applying for $1 million in coverage. Sample rates are for illustration purposes only. Actual rates may vary. Rates as of 4/22/2020.

Premiums for cash value life insurance can be 10 to 20 times as expensive as a 20-year term life policy (the most popular term length). If you don’t have that much disposable income right now, it doesn’t matter what benefits cash value life insurance can provide down the line. Term life might be your best (or only) option.

Relatively low returns

How quickly will your cash value grow? That depends on the kind of coverage you have, but few policies offer the same returns you might see from investing directly in the stock market. This fact is why many financial experts have adopted the mantra “buy term and invest the rest.”

Limitations

Cash value policies have limitations that other savings and investment vehicles don’t. Withdrawing funds usually means paying immediate taxes and fees. And if you don’t pay the loan back the outstanding balance could be deducted from the death benefit your loved ones receive. If you drew on a savings account instead, you wouldn’t have to worry about these limitations.

Cash value policies also tie your life insurance coverage to savings or investments. Combining these financial products could simplify your life, but using your cash value unwisely could jeopardize your coverage. Failing to repay policy loans, withdrawing funds, or using your cash value to pay premiums can eat away at your death benefit, depending on the kind of policy you buy.

How to buy cash value life insurance

When shopping for a cash value life insurance policy, your experience might be somewhat different than shopping for term life. Because permanent life insurance is more complicated, most companies don’t allow you to apply for this coverage—or even see rates—online.

For this reason, it’s critical to work with a licensed life insurance agent. You can get started using our life insurance quote tool (which does include rates for cash value policies).

If you're not ready to start shopping for coverage just yet, keep reading about your options. Use the links below to keep learning, based on what type of coverage sounds like the best fit for your needs.

Cash value life insurance may not be right for families with little disposable income or who aren’t maxing out other savings and investment vehicles. If that’s you, check out the Best Term Life Companies.

But a cash value policy could be the right fit for people who are looking to diversify their investments and are able to fork over large premium payments. If that’s you, check out the Best Whole Life Insurers and Best Universal Life Insurers.

Sources: