Call Today! 888-234-8376

What is Indexed Universal Life Insurance?

Indexed universal life insurance is one of several permanent life insurance products with a cash value component.

Unlike most permanent life insurance products, the interest rate for an indexed universal life insurance policy's cash value is tied to a stock index, such as the S&P 500. As such, your interest rates on your cash value fluctuate.

The biggest benefit of an indexed universal life insurance policy is that it can take greater advantage of stock upswings while protecting against negative trends in the market since the cash value isn’t directly invested. That financial protection makes this life insurance policy popular for retirement income as well as the death benefit.

Besides how the cash value works, however, indexed universal life insurance is practically identical to a universal life policy with its flexible premiums and flexible death benefit amount.

We’ll show you how indexed universal life insurance (IUL) works in more detail below.

Indexed universal life pros and cons

Lifelong coverage

Investment loss protection

Flexible premiums

Options for customizability

Tax-deferred investment growth

Potential for greater interest

Possible higher cost as you age

Investment gains capped

May lapse if underfunded

Complicated

High costs in a down market

Investment cap can be lowered

How does indexed universal life insurance work?

Indexed universal life insurance policies can get complicated, but they all contain two fundamental components: annual renewable term life insurance and an investment-mimicking cash value component.

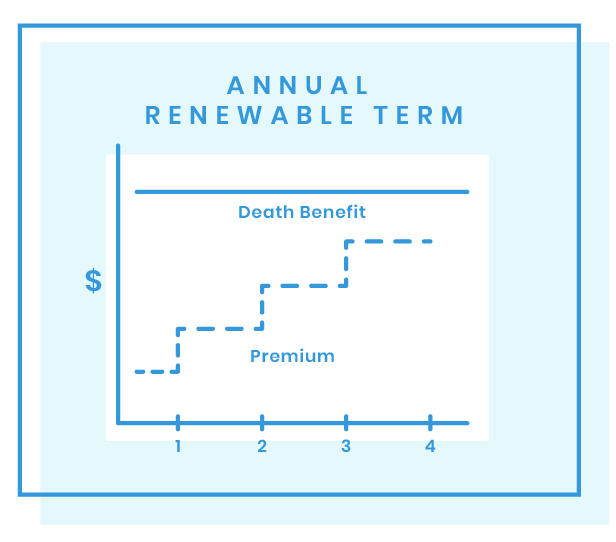

Annual renewable term

Annual renewable term comprises the life insurance portion of an IUL policy. This type of life insurance guarantees a level premium, but for only one year at a time. Premiums are based on your age and the health class you originally qualified under.

As your age increases, so does your chance of death. The premium for annually renewable term increases each year to reflect the new risk but only based on your new age—not additional medical questions or other underwriting.

One instance when additional underwriting might be necessary is if you decide to increase your death benefit. Otherwise, the life insurance component of your IUL will base premiums on your current age and your health class when you initially applied for the life insurance policy.

Investment component

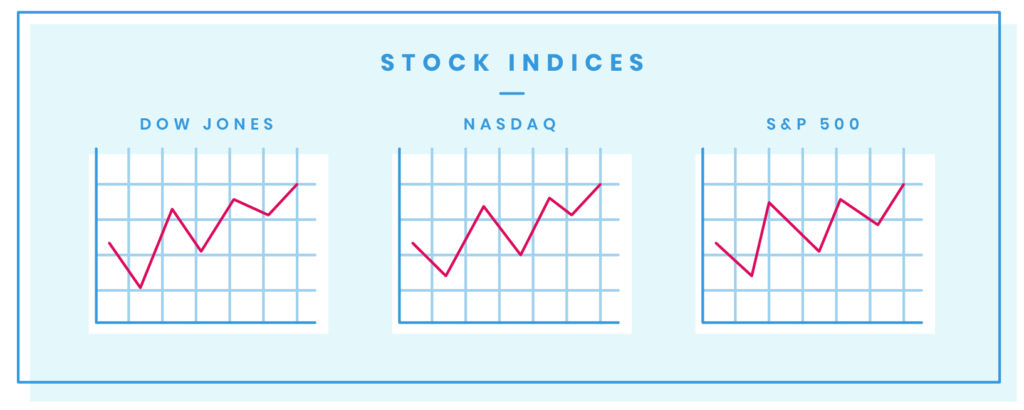

The biggest differentiator with indexed universal life is the “indexed” part. Where universal life policies offer a modestly flexible (but consistent) interest rate, an IUL policy bases its interest rate on an index like the S&P 500, Dow Jones, or Nasdaq.

In practical terms, that means you can capture higher interest rates like you might get in the stock market without being directly invested. This insulates policyholders from the large fluctuations and risks of investing in stocks.

Additionally, the cash grows tax-deferred in the investment account. And like any permanent insurance product, the policyholder can take out policy loans against the cash value. Potentially, this can give you tax-free income during retirement or anything else you'd need quick cash for.

Here are the basic rules of how an IUL’s interest rate works. It may seem complicated, but it’s not too difficult if you break it into pieces—just stay with us.

1. Interest based on an index (without dividends)

Indexed universal life policies typically let the policyholder choose a stock index (basically a chunk of the stock market) that you’d like to base your interest on. The interest rate for your cash value will reflect how the index performs during a set period.

Whichever index you choose, be aware that life insurance companies don’t normally count the dividends earned in that index toward your interest rate. Also, know that your interest won’t equal the index—it’s just tied to it. More on that in the next two points.

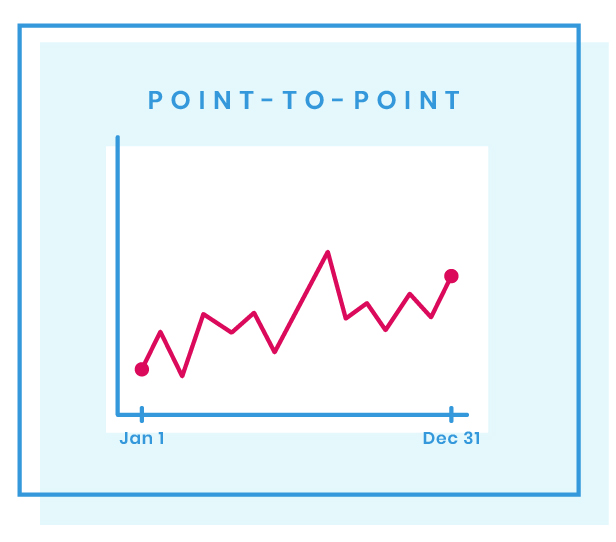

2. Point-to-point crediting

You’ll see the term “point-to-point” in a lot of policies. What it means is that your interest rate doesn’t go up and down regularly like your index will. Instead, life insurance companies will use a period—often annually—and record where the index began (the first point) and where it ended (the ending point).

However much the index grows becomes your interest crediting rate. Then, no matter how high or low your index starts the next year, your starting point resets to zero. However much the index grows during the next year becomes your interest rate.

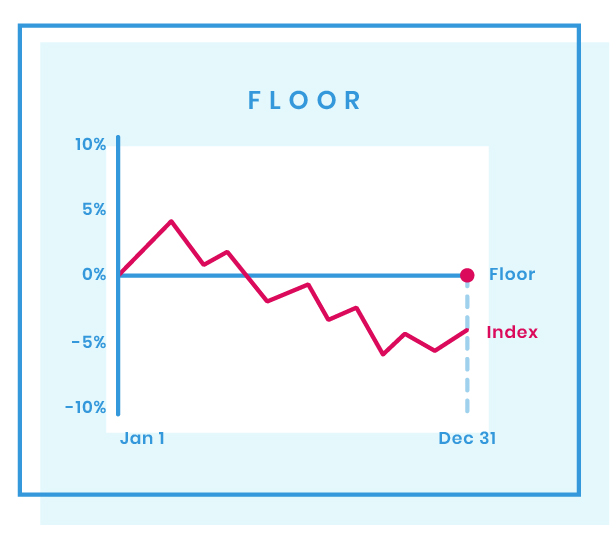

But does that mean you can earn a negative interest rate and lose cash value during bad years in the market? Thankfully not, due to a guaranteed “floor.”

3. Floor and cap on growth

If you were to invest in the stock market directly, you’d have the potential for huge gains but also huge losses. You can avoid both of these extremes with indexed universal life.

Every IUL policy specifies that the interest for your cash value will never dip below 0% (sometimes even 1%). This percentage is known as your “floor,” and it protects against bad years. With a floor, your life insurance policy’s cash value will not decrease despite declining trends in the market.

On the other hand, your growth potential is limited, because policies also specify a maximum interest they’ll allow—anywhere from 8% to 13%. This percentage is called the “cap.”

You’ll never earn interest rates higher than your cap, regardless of stock market booms.

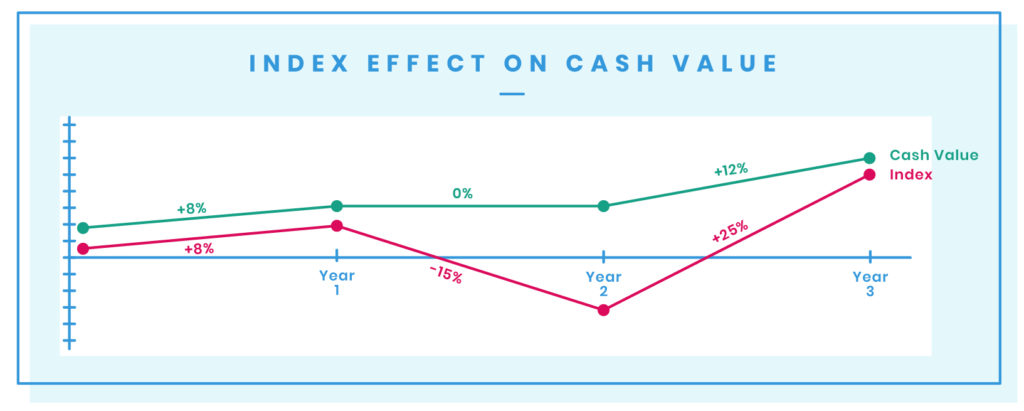

For example, say you bought an IUL policy with a floor of 0% and a cap of 12%. This policy credits interest based on the annual point-to-point.

- If your index grows 8% the first year, the interest on your cash value will grow 8%.

- Then, say your index crashes the next year, down 15%. Your interest rate will be 0% (protected by the floor), and your cash value will stay the same.

- Wait, but the following year your index rebounds and grows 26%! You’ll see only 12% of that growth reflected in your cash value, though, due to your cap.

This is an oversimplified example, but the main idea is that your cash value will not decrease in a bear market. It should either increase or stay the same in an IUL.

Here’s the tricky part: life insurance companies don’t have to stick to the caps they specify in their brochures. They could lower them whenever they want. That doesn’t necessarily mean they will, but it’s good to know that fine print detail before you buy a policy.

4. Participation rates

Just to add another level of complexity, your indexed universal life insurance policy may also talk about “participation rates.” That’s just a fancy name for the percentage of the gains they’ll credit to your interest. It makes more sense when you look at an example:

If your IUL policy's participation rate is 80% and the interest on your policy is 10%, you’ll earn 8% interest.

Using a grossly oversimplified example, if your cash value is $100, that means you’ll earn $8 in interest (80% x 10% x $100).

Each policy sets its own participation rate, determined by the life insurance company. Sometimes participation rates are 100%, but they can be as low as 25%.

Does an IUL get more expensive as I age?

It can, but if it’s doing what it’s supposed to, it shouldn’t.

The cost to insure you is called the cost of insurance (COI). Your cost of insurance in an indexed universal life policy is based on your death benefit minus your cash value. Supposing your investment performs well (like it hopefully will), your cash value significantly reduces your COI because of a lower net death benefit—the difference between your cash value and your death benefit.

However, if your index were to perform really poorly, you may have to pony up higher premium payments to cover your cost of insurance and to keep your life insurance policy from lapsing.

If you find yourself in a situation where your premium is rising uncomfortably high, you can always lower your death benefit. Then, once your cash value recovers, you can raise it again if you wish. If you go this route, however, you might need to submit to additional underwriting.

Whole life vs. indexed universal life

Whole life is a more straightforward cash value life insurance product. Its premiums are fixed, its death benefits are fixed, and its interest rates are fixed. If you want predictable, easier-to-understand permanent life insurance, whole life may be more your speed.

Indexed universal life lets you play with the numbers. The death benefit is flexible. The interest rate is flexible. The premium payment is flexible to the point that you may even be able to skip payments (but only if you have enough cash value to cover the cost of insurance). You can also lower or raise your premium payments as your income allows.

Which one is better? It mostly depends on what you’re more comfortable with.

401k vs. indexed universal life

They’re different enough to merit an entire article—and there are quite a few out there from the perspective of a financial professional. But even financial professionals can't seem to agree on which one makes the most sense for consumers.

The biggest thing to keep in mind is that a 401k is designed for retirement, and indexed universal life is a life insurance product. Although indexed universal life gets touted as an investment vehicle, it’s not an apples-to-apples comparison to a 401k, which invests in mutual funds rather than stock indices.

The bottom line on indexed universal life insurance

Indexed universal life policies are like snowflakes: no two are exactly alike, and you probably need a magnifying glass to inspect the fine print.

Although we went in depth about what you’ll likely see in every IUL insurance policy, there are many other variables you’ll see on individual policies that we can’t get into here, such as multipliers, spreads, and riders. With so many moving parts and factors to consider, do your homework. Work with someone you trust to see if your financial plan would be suited to include indexed universal life.

If you’ve made it this far and you’re not sure indexed universal life is the right choice, you have other options:

- If you want flexibility but less risk, look into universal life insurance.

- If you want predictability with permanent protection, consider whole life insurance.

- If you want the most affordable option, term life insurance is your best choice.

On one final note, indexed universal life isn’t the only life insurance policy with a stock market-based cash value. Variable life insurance is a product much like an IUL, except variable directly invests your cash value in the market. That comes with a higher threshold for gains, but at a higher accompanying risk.