Call Today! 888-234-8376

How Much Does Life Insurance Cost?

When people start talking about life insurance, we tend to overestimate just how much it will cost in order to get the coverage we need. In fact, most people incorrectly assume life insurance costs three times more than it actually does. On average, a healthy 30-year-old will pay $13.33 per month for a $250,000 term life insurance policy, or $160 annually.

That’s less than your HBO subscription.

Yep, you can ensure your family’s financial security in the future, for the same price you pay to watch Game of Thrones on repeat.

So how much cash will you shell out for your life policy? That depends.*

- A 20-year-old man could get a $250,000, 10-year term life insurance policy for the price of his monthly Spotify subscription (about $10/month).

- A 40-year-old woman could get $1 million of 20-year term life coverage for the cost of 12 Grande Starbucks lattes (about $43/month).

- A 30-year-old woman could get $250,000 of permanent coverage from a universal life policy for the price of six cocktails (about $78/month).

- And a 50-year-old man might get a $500,000 whole life policy for 1/7 the cost of an average Super Bowl ticket (about $800/month).

*Sample quotes based on rates provided by a Clearlink Partner and are for illustration purposes only. Actual quotes may vary. Data effective: 12/3/19

When it comes down to it, insurance companies can’t give accurate life insurance quotes without asking a lot of questions first. And most folks don’t want to answer a bunch of questions without knowing how expensive life insurance coverage is. It’s a catch-22.

Let’s get you out of this financial pickle.

No, you don’t have to fill out a questionnaire or take a medical exam to get some answers. Instead, we’re going to give you the inside scoop on how companies price life insurance. Soon, you’ll know exactly how the following six factors affect your life insurance rates.

1. Age

First and foremost, companies price life insurance rates by age. In general, the younger you are, the lower your rates. When you're in your 20s and 30s, rates increase very little from year to year, if at all.

If only time stood still from then on, eh? Unfortunately, you can expect rates to grow more quickly in your 40s. Then there’s another big jump when you hit your 60s.

To complicate matters, most insurers stop offering specific policies to folks of a certain age. You might have difficulty finding a 30-year term life policy by the time you hit your 55th birthday, for example.

If you’re after a low monthly rate, your best bet is to buy a policy as soon as you can.

2. Health

After age, health impacts life insurance rates most. Insurance companies use rate classes to group folks with similar health levels together. It’s like getting a grade for how healthy you are.

Every insurer grades on its own curve, based on your medical exam results or a health questionnaire you fill out. One company might put more emphasis on a person’s blood pressure or cholesterol levels while another focuses more on mental health or body type.

A typical company’s rate class system might look something like this one:

- Preferred Plus: Excellent health, ideal body type, clear family medical history, and no nicotine.

- Preferred: Very good health with slightly high cholesterol or blood pressure and good family history.

- Standard Plus: Good health with a few issues, such as nonideal body type, but good family history.

- Standard: Test results show some red flags, nonideal body type, and major illness in family history.

Below Standard, you’ll typically see numerous substandard classifications. The lower you fall on the list, the more money you’ll need to set aside for life insurance.

You can't know for sure which class you'll fall into before applying, and some companies may reject some applicants based on health. That can make shopping around for coverage a challenge.

But there's a silver lining: if you have health issues or think you were unfairly placed in the wrong rate class, try another company. Plenty of companies make names for themselves as having the best pricing for specific medical conditions or by offering no exam life insurance policies, so don’t give up!

Rate Classes for Tobacco Users

If you smoke, your rate classes might be much simpler but cost more money: Preferred Tobacco or Standard Tobacco. Why? Because smoking has such a profound impact on health, most insurers price smokers in their own categories. Find out how insurers define “tobacco use” on our life insurance questions page.

3. Type and term

No one has control over their age or all their health issues. But you can decide what type of life insurance policy to get and how long you want life insurance coverage.

Most folks choose from three main types of life insurance:

- Term life insurance covers you for a certain period of time, commonly 10, 20, or 30 years.

- Universal life insurance covers you until a certain age, such as 95, 105, or 121.

- Whole life insurance covers you until you die or up to age 100, provided you continue to pay the premiums.

Term life is the cheapest kind of life insurance—the shorter the term, the lower the cost.

Universal life insurance coverage costs a bit more than term, and whole life insurance typically costs even more. Both universal and whole are considered permanent policies.

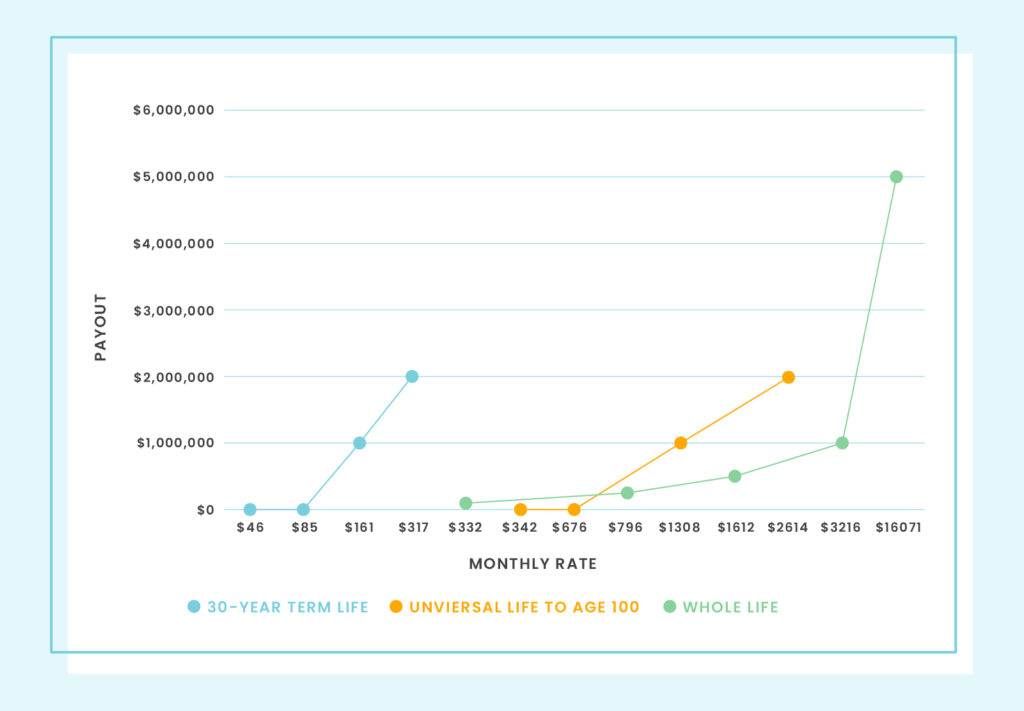

How much do type and term affect rates?*

- If you choose a term life insurance policy, you can expect to pay an additional 20% to 50% for every five years you add to your term.

- A universal life policy might cost 260% to 330% more than a 30-year term policy.

- A whole life policy might cost 110% to 130% more than a universal life policy.

What’s the best type of life insurance for you? That depends on your budget, how long you expect to need coverage, and cash value you want. Check out our article on the three main types of life insurance to decide.

*Source: Calculations based on rates provided by a Clearlink Partner. All rates as of 10/30/2018.

4. Payout

Another choice you get to make is the payout. Also called the death benefit, the payout specifies the amount your beneficiaries receive if you die while the policy is in force. The higher the payout you want, the higher your monthly life insurance premiums will be.

Payout size affects rates differently for different types of policies. You can expect a 50% to 75% difference in premiums between payouts of $250,000 and $500,000 for a term life policy, for example. A $500,000 universal or whole policy will cost 95% to 130% more than one with a $250,000 payout.*

So what payout should you get? Find out with our life insurance calculator to estimate your coverage needs.

*Source: Calculations based on rates provided by a Clearlink Partner. All rates as of 10/30/2018.

5. Gender

Life insurance rates in the United States aren’t gender-neutral. Women typically pay lower monthly premiums than men. And for most life insurance applications, you have to select “M” or “F,” although this is slowly changing as some companies add unisex categories to their pricing.

Fortunately, gender in life insurance isn’t about discrimination. It’s about statistics.

On average, women live around five years longer than men. In short, insuring guys costs more than covering gals.

How much more? The difference grows with age. And that makes sense since the average life expectancy is 76.1 for a man and 81.1 for a woman. Each has about the same risk of dying in their 20s: very little. Fast forward 50 years, however, and the average man will be nearly twice as close to death as his female counterpart.

But compared to other factors, gender doesn’t affect premiums all that much. In most cases, the difference is between 15% and 30%.*

*Source: Calculations based on rates provided by a Clearlink Partner. All rates as of 10/30/2018.

6. Life choices

Finally, your life choices affect your life insurance costs too. Some of these choices are small, like using a cellphone while driving. Others are big, like summiting Mt. Everest. And some, like working the hay bailer on the family farm, might not seem like choices at all.

Most choices that affect life insurance rates fall into four categories:

Occupation

Surprisingly, the riskiest jobs aren’t in law enforcement or the military. In the deadliest professions, people work around heights, machinery, and roads.

Hobbies

Just because you don't get paid to take risks doesn't mean doing so won't affect your rates. For instance, if you ride a motorcycle, have a pilot's license, or backpack through the wilderness on the regular, you're riskier to insure.

Driving

Motor vehicle accidents cause the second-most accidental deaths in the US (40,231 people in 2017), after accidental poisoning. As a result, most insurers check your driving records as part of the application process.

Travel

Traveling to dangerous or medically underserved destinations increases your risk of death. Pair that with the fact that 30% to 50% of tourists become ill or injured while traveling abroad, and it’s understandable that many insurers ask about your travel preferences before quoting a rate.

Insight from experts

We asked life insurance experts to weigh in on how to save money on life insurance premiums. Here are their tips.

Find Doug at Ogletree Financial.

Find Matthew at Loyal Christian Benefit Association.

Find Henry at Friendly 401K.

Find Michael at RiskQuoter.

Life insurance is notorious for being a bit behind the times when it comes to online applications. Luckily, there are a few companies that do offer an online application that is quick and easy to fill out.

*Issuance of policy may depend on answers to a medical questionnaire.

Conclusion

Life insurance pricing is complicated, but understanding what kinds of things factor into rates may help you lower your costs and live a longer, healthier life.

That said, we don’t usually recommend shopping for life insurance based solely on how expensive the right policy is. You should choose the right insurer too. Start your search for the right insurance company with our top-rated life insurance companies list. Find a few companies you like, then use price to narrow your options.

After all, you're now armed with a clearer understanding of how insurers choose those prices. A good deal can’t be far behind.