Call Today! 888-234-8376

The Ultimate Financial Guide for College Grads

According to the Bureau of Labor Statistics, 72% of 2018 college grads with bachelor’s degrees were employed by October of last year.1 If that trend continues this year, nearly 1.4 million new graduates like you will join the workforce in the next few months.2 Unfortunately, 65% of new graduates will have student loans, little to no education about how to handle personal finances, and a shiny new paycheck that makes you feel like the next Kardashian.

To help you graduates new to the workforce keep your heads amid your first real financial freedom (and responsibilities), we put together the SparkNotes version of what every graduate needs to know about building financial health.

Create a budget you can stick to

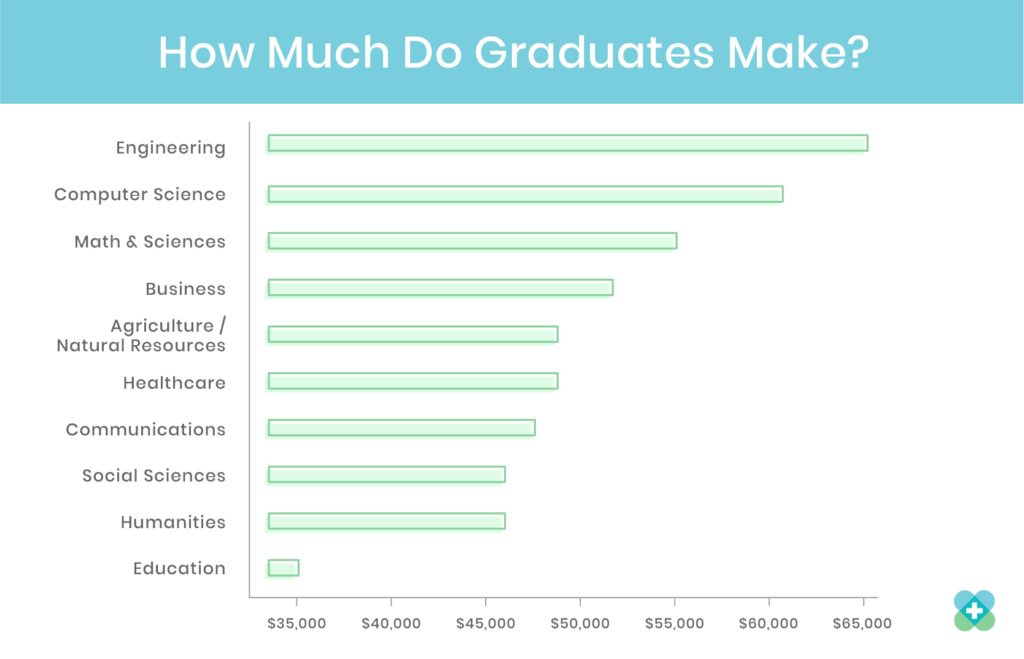

The average graduate with a bachelor’s degree makes $50,556, with some variation based on major.3 But earning the big bucks isn’t the key to financial health—budgeting is.

According to a National Foundation for Credit Counseling (NFCC), March 2019 report, just two in five adults keep close track of their spending with a budget. That same ratio—or 40%—also carries over a balance on their credit cards each month.4

But you can avoid debt and overspending by keeping a budget. Keep it simple and quick and use an app like Mint or You Need a Budget to stay on track.

Beware of unnecessary purchases

While receiving your first paycheck can make you feel like a million bucks (or, at least a few hundred), don’t go overboard in celebration—or spend unnecessary money on things just because your peers are making those purchases.

What should you spend your money on? We asked Todd Christensen, Education Manager at Money Fit, a nonprofit counseling agency. He shared Money Fit’s Money Pie—a breakdown of the ideal way to divvy up your paycheck.

- 10% Give: Donations, taxes, and acts of kindness.

- 50% Live: Rent or mortgage, utilities, transportation, cellphone, internet, groceries, and clothing.

- 10% Prepare: Emergency fund, car repair or replacement, travel, gift giving, furniture and appliances, and other short-term goals.

- 10% Plan: Retirement, down payment on a home, or other long-term goals.

- 10% Improve: Increase your income-earning potential through education (or paying off student loans), training, or starting a business.

- 10% Enjoy: Have fun without guilt of breaking your budget.

Get the job benefits you deserve

Benefits are an important part of your compensation: the Bureau of Labor Statistics estimates employee benefits add around 32% more value to your pay.5

To get the most out of your benefits, follow these tips:

- Go over all available benefits with your employer’s Human Resources specialist and ask lots of questions.

- Pay attention to sign-up deadlines so you don’t miss them.

- Carefully weigh whether to add optional benefits, such as accident or long-term disability insurance.

Pay off student loans

The average four-year college graduate starts professional life with nearly $29,000 in debt. While most of these grads will succeed in paying off that debt, some—especially those who attended for-profit schools or are first in their family to attend college—will struggle more than others.6

Whatever your circumstances, don’t let student loans start you down a path toward financial instability.

- Avoid missing payments by setting up autopay through your bank.

- Eliminate debts faster by paying more than the minimum.

- Make loan payments non-negotiable: cover them before budgeting for anything else.

Start investing

If you don’t have a finance degree, investing might seem intimidating. But the most important thing to know is this: the earlier you start, the more money you can earn. The easiest way to invest is to start contributing to a 401(k) retirement account, if your employer offers one.

Additionally, check to see if your company offers a matching contribution. If they do, and you don’t contribute the full amount they offer to match, it’s like refusing to accept part of your pay!

If your employer doesn’t offer a 401(k), start your own Individual Retirement Account (IRA) through a company like The Vanguard Group or Fidelity.

These plans make investing super easy. Just complete these two steps:

Choose one or just a few funds to invest in

Each financial company has different offerings, so browse your options. Then, we recommend checking out The Index Card by Helaine Olen and Harold Pollack (available at Amazon.com) to decide which funds are best for you.

Decide how much to invest each month

Invest at least the amount your employer will match. As mentioned above, if you don’t, you’re leaving free money on the table.

Get life insurance

As a young, healthy college grad just starting your career, “end of your life” issues are even farther from your mind than retirement. But now is the best time to start planning. The most important factor in the cost of life insurance is age. The younger you are, the cheaper your rates will be—now and later. A healthy 20-year-old female might lock in a $250,000 30-year term policy for just $15 a month. At 40, she might pay $24. And at 50? She’s looking at around $54 per month for the same return.7 Clearly, time is on your side, and just a little investment goes a very long way. Your 50-year-old self will love you for it.

Not sure you need life insurance? A good test is to ask yourself whether anyone you care about—or might eventually care about—would be put in a tough spot financially if you were gone. Would your parents get stuck paying off your student loans or other debt? Would they dip into their savings to pay for your funeral? Do you hope to someday have a significant other or even kids? If you answer “yes” to any of those, then you probably need life insurance.

Looking ahead

Now that your graduation tassel is on the left, it’s up to you to get those finances in order. But don’t sweat it. Just make a simple plan and then stick to it. Trust us. Smart choices now mean today’s shiny new paycheck could grow into a pile of cash that would make a real Kardashian jealous.

What’s the first thing you’ll do to get your finances in order after graduation? Tell us in the comments below.

Sources

1. Bureau of Labor Statistics, “College Enrollment Work Activity of High School Graduates News Release”

2. National Center for Education Statistics, “Fast Facts”

3. Money, “Here’s What the Average Grad Makes Right Out of College”

4. NFCC, “2019 Road Map of Consumer Financial Health”

5. Bureau of Labor Statistics, “Employer Costs for Employee Compensation New Release”

6. The Institute for College Access and Success, “Student Debt and the Class of 2017”

7. TermLife2Go, “Best Life Insurance Rates By Age”